Get monthly coaching and support to FINALLY gain momentum in your business without burning out in the process. 🦄 Learn more about WAIM Unlimited.

In this article, we hope to help you learn how to grow your online business monthly revenue from $0 to $10,000++. We are NOT about overnight success or viral tactics, which is why we call this process: Grow It Gradually 🦋.

👋 PLEASE READ: Before you scroll to the $10,000++ section, the idea behind this article is NOT to leap from $0 per month to $10,000++ per month overnight. That’s simply not possible. But, what is possible is to make small revenue jumps over time with your business. Remember, taking the slower 🐌🐢 approach to biz is still a successful way to grow!

We’re going to share 3 tips in each revenue “level” of your business so that you can Grow It Gradually 🦋. The five “levels” we’ve identified and experienced are as follows:

We want to make it EXTREMELY CLEAR that regardless of how much money your business makes, you are welcome and celebrated just as you are! There are SO many more important, more interesting measures of success and growth beyond just money.

But alas, in our experience, money can buy FREEDOM and that’s really what we want for you.

We hope, in each section of this article, you walk away with actionable takeaways for whichever level you’re currently at or striving to get to (at the pace is right for YOU!) Now on to the show…

Welcome to our Grow It Gradually 🦋 article where we’ll walk you through how to jump up 5 different revenue levels in online business. And as a final reminder, making more money doesn’t make you better at business or more important than anyone else 🤗.

When we were just getting started with our businesses, one of the biggest issues was trying to figure out what type of business and revenue model to pursue.

Online courses sound great, but if you don’t have an audience, who are you selling them to? The unfortunate answer is: No one 😩😩😩.

Software (aka SaaS) is cool, but if you have zero developer skillz (yes, skillz), it’s going to be a looooooong time before you can start making money.

Service-based businesses come in many shapes and sizes: Graphic design, web design, web development, virtual assistance, copywriting, art therapy, personal styling, social media management, the list goes on and on.

Essentially, you are a person with a specific skill, getting paid for the hours you work for someone else’s business.

This is a GREAT business model to start with because you don’t have to have a big audience or a social media following; all you need is to have cultivated a specific skill that you can monetize. With just a few clients in the door, you’re likely making enough money for a healthy side business (rather than a products-based business which would take significantly more sales and effort to make the same amount of money.)

💡 For the rest of Grow It Gradually 🦋, we’re going to use a fictitious business example so you can put yourself in the shoes of a fledgling biz and watch it grow. Let’s call our business… Oodles of Poodles Web Design 🐩🎨. Here at Oodles of Poodles, we specialize in helping people launch elegant websites on Squarespace. We focus on designing and building websites for small business owners in the health and wellness space. (Are we health and wellness experts? No! But we know there are many new businesses popping up in that niche and we love a good skincare routine as much as the next person, so we’re going to target them.) Our mascot is Prism, a lovable Poodle who has yet to learn how to build websites, unfortunately, but we’re working on training her! 🐩

Great, the (fictitious) business is established and we know who we can help [health and wellness experts] and with what services [Squarespace website design] we can help them with. Now, let’s get into the three tips in this section for Oodles of Poodles 🐩🎨 to get their business foundation right and their first client(s) in the door.

You may have noticed in the short bio for our fictitious business, we offhandedly threw out there our web design company focuses on helping small business owners in the health and wellness space. THIS. IS. IMPORTANT.

One of the biggest mistakes we made early on that we see new business owners make as well is NOT specifically stating who your business is for.

It may seem limiting to pick a specific group of people that can pay you money, but trust us, if you cast too wide of a net and just say you do “web design for small businesses” you aren’t going to ATTRACT 🧲 anyone. We’re going to go into more detail about this in the next section.

The other part of this first tip is to identify what exactly you do.

For Oodles of Poodles 🐩🎨, hopefully you noticed we wrote “build elegant websites on Squarespace.” We want to focus on the skills we have and the software we know how to use.

We don’t want to learn how to use WordPress, Wix, Weebly, Webflow, or any other website platform that starts with a “W” 😂😂. Plus, this is another way to attract a specific type of customer who uses the platforms you know.

Once you can answer these two questions, the logical first step is to create a website.

This is very important though: Don’t overthink this step! Give yourself a specific deadline of when your website needs to be launched for your biz. Constraints are incredibly important and we’ve all had those “under construction” pages up on our sites for longer than we should’ve.

Everyone open your ears… 👂👂… Are they open? Good. You ARE going to have to reach out to people before your business is “perfect.”

You ARE going to have to put yourself out there on a limb that’s a bit uncomfortable. We ALL do this!

To get your first couple of paying clients, you may need to do things like:

📌 *Related content alert: We recorded a podcast 🎙 episode titled, A foolproof way to get more clients, and it’s worth a listen if you’re at this stage of biz.

It’s really really really important to avoid overthinking everything early on in your business. Oodles of Poodles 🐩🎨 is not going to get its first paying client with hopes, prayers, and crossed fingers. It takes doing outreach and being proactive.

Promoting yourself ≠ being a sleazy salesperson. Those are not the same things. We love this quote from Tina Roth Eisenberg:

Head’s up: Be prepared that your friends, family, and acquaintances may criticize you for putting yourself (and Oodles of Poodles 🐩🎨) out there.

We’ve learned that nearly all criticism in business comes from other people’s insecurities and fears. Know this, and put on your invisible suit of armor, ready to ward off any unwanted criticisms of your new biz!

One thing we don’t see enough new biz owners do is leverage the “new-ness” of their business to create buzz early on.

Now, we understand being quiet is more natural to some people, but businesses need to be seen/heard before they can get paid!

Here’s what we’d do for Oodles of Poodles 🐩🎨 if we were just getting started:

Optional: If you’re a much more extroverted person, you could also do some sort of video launch. It could be done on Zoom, YouTube Live, IG Live, etc, and the entire call-to-action of your buzz-worthy event would be to attend that (instead of OR in addition to the email signup).

This type of launch event is not just about getting those first three paying clients. It’s about doing what we talked about in Tip #2: showing people your biz exists!

If you get a paying client, that’s obviously your main goal, but at this stage of the game, just getting people to know you are offering this service is critically important.

If you can work through these three tips, you should absolutely be well on your way to landing your first paying client (or two, or three!)

There’s no specific timetable on how long these things should take, but we’ll remind you of one important thing: You have to get started before you feel 100% ready! No one feels 100% ready at the $0 stage of business.

Next section, we’re on to our next stage and we’ll tell you what to focus on next once you earn hit that first $500/month benchmark. 🦋

⚡️ Tip #1: Be clear about what you do and who you do it for (ps. You need a website!)

⚡️ Tip #2: Start BEFORE you’re ready and courageously practice putting yourself out there.

⚡️ Tip #3: Create a buzz-worthy “launch” event.

Let’s say your business is generating around $500 every month and that’s about 500x better than $0, but you know $500 can’t pay all your bills, so you’re looking to grow. What do you do?

If you missed it in the previous section, we’re going to use our fake business Oodles of Poodles 🐩🎨 Design Studio (a company that does Squarespace website design for health and wellness businesses) as our ongoing example.

One of the most important ways you can grow your business is to get crystal clear on WHO your target customer is.

Even with our Oodles of Poodles 🐩🎨 business, we’ve narrowed in on “health and wellness” clients, but even that niche can be very broad.

Using the tips from the previous section, hopefully, you’ve been able to take on a few clients by this point, but since you’re still in that early stage you may have felt the need to say YES to each and every client inquiry.

That’s totally okay! But if you really want to grow, it’s time to get laser-focused on attracting a specific type of client. Think back to which clients you enjoyed working with the most, and try answering the following questions:

1️⃣ Is there a pattern to what these clients do? (Instead of “wellness companies” are most of your favorites actually yoga instructors?)

2️⃣ Is there a pattern to why they are looking for a [insert your business here] to help them? (Multiple clients have said they “don’t consider themselves creative” and “they are frustrated by trying to design their own website”.)

3️⃣ Is there a pattern to what they’re asking for? (Maybe you started out thinking you’d design 10-15 pages per website, but the best clients are happy with 4-6 pages.)

Just by answering those questions, you can paint a much clearer picture of the IDEAL customer you want to attract and how to speak to exactly what they want.

And where do you apply that lovely business-paint? You spell it out clearly on YOUR website and in all your promotional copy!

At the $500/month level of business, it can be easy to fall in the trap of taking on any client that comes your way because you’re afraid to turn down money. But we found from our own experience and helping many people over the years, saying yes to clients who AREN’T your ideal customers is the quickest way to NOT enjoy your work and to muddle your messaging. The quicker you can create cohesion and clarity in your portfolio and your website copy, the quicker you will see results of more and more ideal clients coming to YOU.

Back when Caroline 👩🏻🦰 started her first online business in 2014, a design studio called Made Vibrant, she marketed herself as a do-it-all-designer (hand-lettering, logos, graphic design, print design, branding, websites, etc.) She could apply her design skills to all these different projects, so why not cast the net as wide as possible, she thought.

After working with the first few clients of Made Vibrant, Caroline went through the questions we just posed in Tip #1 and found there was a more focused approach she wanted to take.

Instead of being a do-it-all-designer designer, she realized her favorite projects were designing brands for first-time creative entrepreneurs. She loved the feeling of confidence she could see in her clients after they had a clear and unique brand identity they were proud of.

This decision to stop being a jack-of-all-trades and instead develop a clear expertise in brand design is the point where clients finally starting seeking out Caroline instead of her always needing to go out and find them. It marked a turning point in the success of her business.

This approach is about being specific in stating exactly what your expertise is, exactly who you can help with your business, and exactly what makes you unique (and even a bit weird!). It’s Caroline’s version of becoming a Brand Designer. For Oodles of Poodles 🐩🎨, it’s about knowing that Squarespace sites for technology-frustrated yoga instructors is the sweet spot.

When you stop being vanilla and “for everyone,” you start to ATTRACT your ideal customers and repel customers who aren’t a good fit for you (sorry spa and gym owners, these poodles aren’t oodling for you!)

This approach is the ole “spray and pray” idea. You’re hoping if you keep things generic enough in your copy and promotion that the right customers will fall into your lap (amidst all the wrong customers).

Yet, what tends to happen is that you don’t get any customers because people don’t know if you’re the right fit. You get stuck in place and you end up taking on bad clients and doing work you don’t want to do.

By creating more clarity in who you want to help and how you can help them, you’ll 🧲 more of the right customers for your growing biz.

Remember, don’t be afraid to “repel” people at this stage of your business. The more you can become known for doing something specific really well, the better your chances are of getting paid to do that thing!

Buckle up, buttercup! It’s time to take control of your business and build an audience of people who care about what you have to offer the world.

⚠️ IMPORTANT: Any existing service-based biz owners might be thinking, “Hey, I’ve made it this far in my business, why would I start an email list and put extra work on my plate??” And the answer is three-fold:

The sooner you build an engaged audience (one that’s NOT at the mercy of social media algorithms), the sooner you’ll be able to start thinking about transitioning away from trading time for money. We’ll talk more about that in the next Grow It Gradually 🦋 levels below.

It’s a way for you to attract people out in the chaotic catacombs of the Internet and stay connected to remind them how you can solve their problems.

By showing up consistently in someone’s email inbox (where algorithms don’t punish you), you build trust and authority with them. You also give them a constant reminder of Tip #1 (who your business is for) and #2 (what your expertise is) in this email! Read more about our concept of “Marketing Bridges” here.

Using our trusty biz Oodles of Poodles 🐩🎨 as an example, we’re not just going to say, “Sign up for cute photos of Prism the poodle 🐩.” Instead, we’re going to have a bi-weekly email newsletter that shares A) a case study of an awesome yoga website and brand we found and B) a hot, new thing we learned in Squarespace. Okay, also C) an adorable photo of Prism doing something suuuuuper cute.

You want to attract 🧲 your ideal customers to your email list and consistently show up in their inbox on a schedule you can keep up with. These subscribers will hopefully become customers as you add in callouts for client availability in your emails!

⚡️ You can NEVER start an email list early enough. Trust us, even if one day in the future you were to pivot your entire business model (which we’ve done many times over the years), the right audience will move along with you. ⚡️

Having a captivated audience you can mostly control your interaction with is extremely important in business and will be absolutely mandatory to grow to the $1,500, $3,000, $5,000, and $10,000+ biz levels.

These three tips aren’t going to immediately help you jump from $500/month to $1,500/month in your business but, spoiler alert, no one has a silver bullet to help you do that.

We’re all about that gradual, sustainable growth 🦋 around here. It helps you keep balance in your life and to avoid burnout at all costs.

Next section, we’ll jump up to the $1,500/month level of business, with new tips to help you at that stage 📈.

⚡️ Tip #1: From your first few customers, can you look for patterns and identify a clear customer profile?

⚡️ Tip #2: Develop a clear skill-based expertise that people are searching for.

⚡️ Tip #3: Start building an email list… TODAY.

Our previous two sections have been about your client service-based business, and this section will be the last one in that arena before we start transitioning into scalable, digital products.

Too often, though, we see online biz owners try to make the leap into digital products too soon, while not building enough client runway to sustain the time that transition takes.

As a reminder, we are all about slow, methodical growth in business 🐌🐢,which often means sticking with client work for a while longer to avoid burnout and dips in business revenue.

When you’re at the $1,500 per month revenue mark with your client business, you’re probably not quite at the stage where you can cover all your bills with your profit (some folks may, and if that’s you, AWESOME 👏👏!) This is why our first tip in this section is to continually be investing time in your client outreach and potential client lead list.

Where do you find leads? Start with who you WANT to work with! Based on the previous 🦋 section’s tips, you now know the importance of getting super-specific about who your ideal client is. Use that info to search your social media channels for businesses and business owners that fit the criteria you established in the previous section.

By clearly knowing exactly who you want to work with it becomes much easier to search those clients out and put them in an outreach spreadsheet.

It seems like suuuuch simple advice, but we’d be willing to bet our merino wool socks most client-based biz owners do not have a client outreach spreadsheet. If that’s you, that’s okay! Now’s the time to fire up Google Sheets, Numbers, Airtable, Notion (aff link), or if you absolutely have to… Excel 😬🙈. Having a spreadsheet/database with a list of potential clients is how you keep your business organized and your leads nurtured.

🗓 Carve out one day per week to nurture your leads and create/send pitches! It is very unlikely that you’re going to grow your client roster at this stage of your business simply through your social media content creation (aka: posting on IG or TikTok) and referrals from the few clients you already have. You can’t sit back and have a, “they’ll come to me” mentality; you have to be thinking, “Let me go find them!”

This is why it’s key to put time on your calendar each week to invest in the future of your business! We actually have three sub-tips to this tip’s sub-tip 😂 #tipception:

New clients aren’t going to fall in your lap which means more money isn’t just going to magically appear in your bank account.

An easy trap to fall into when you’re starting a client business is to have one core service offer (which is great!) but then not give yourself permission to experiment 🧪 with other revenue-generating ideas.

For this second tip, we want to encourage you to think about a smaller, mini offer that isn’t a huge ongoing time commitment but could bring in a splash 💦 of revenue to your biz! A gradual splash, you know? A spritz. You get it.

If you recall, our fictitious business we’ve been talking about these past few sections is Oodles of Poodles 🐩🎨, a Squarespace design company for yoga instructors. The main offer (website design and build) can take weeks of work to complete, so let’s brainstorm 3 other offer ideas that require less time:

OFFER IDEA 1️⃣: Squarespace bug fix day – For $500, you’ll spend a day ironing out any bugs on someone’s site. These could be CSS-related, email form setup, page organization, etc.

OFFER IDEA 2️⃣: Squarespace site setup – For $500, you’ll hop in someone’s brand new Squarespace account and get all their pages set up (Home, About, Blog, Product, and Contact), their blog started, and their settings how they want them.

OFFER IDEA 3️⃣: Homepage redesign blitz – For $500, you’ll redesign someone’s homepage and offer them two layouts as a refresh from what they have now.

As you can see with these offer ideas, they don’t take ongoing work and can create a nice bump in monthly revenue. If Oodles of Poodles 🐩🎨 was able to land 2-3 of these per month, that could quickly help them add $1,500 in monthly revenue without any ongoing work.

⚡️💡 BONUS TIP: If you’re a savvy offer creator, your smaller offer could be a GREAT lead-in to your larger client package. Offer Idea 3️⃣ (homepage blitz) is a great example of this and could lead to someone starting with paying $500 but then wanting help implementing the design for a larger client package!

We like to think about foundation articles on your website like the old Chinese proverb about planting a tree: “The best time to plant a tree was 20 years ago. The second best time is now.”

Similarly, if you’re wondering when you should get some SEO-friendly articles published on the blog of your website, the answer is as soon as possible.

Foundation articles are great for short-term and long-term (gradual) business growth.

🩳 Short-term growth – Once you have your articles written and published, you can share them on your social media channels and try to convert those folks into email subscribers. Your articles become immediate marketing opportunities. They establish trust with your audience as your followers begin to see you as a source of expertise.

👖 Long-term growth – The goal one year from now is that the almighty Google (or Bing – LOL) has seen your article(s) as helpful for certain keyword searches and you’re getting organic traffic to your site which converts into new email subscribers!

If you’ve been putting off writing articles that can build organic traffic (which lead to new email subscribers) it’s time to stop delaying this task!

What are “foundation articles?” Plain and simple, they are helpful articles that can attract your ideal customer based on problems they’re searching for on Google. Shall we take a look at some examples for our friend at Oodles of Poodles 🐩🎨? We should?? Okay, then!

These are not perfect ideas BUT there are no perfect ideas in any part of business! You want to do a bit of search term research (which we did for those 6 article ideas) and adapt what you find to fit what your ideal customer is looking for.

📌 Related: Does SEO completely baffle you!? It used to baffle us to until we learned just enough and put that enough into practice. Learn everything we know about SEO here!

📌📌 Related #2: If you want to learn our full content strategy read our Content Salad Strategy guide (with even more foundation article advice).

Next section we’re going to venture past the client-side of growing your business gradually!

⚡️ Tip #1: Focus one day of your week on client outreach and new client pitches (build that spreadsheet!).

⚡️ Tip #2: Get creative with your client offers and experiment with a mini offer!

⚡️ Tip #3: Write 6-8 foundation articles that can bring you more email subscribers today and a year from now.

We absolutely HAVE to start this section off with a big disclaimer:

🚨 TRUTH ALERT 🚨

The stage of your business where you transition from clients (trading time for money) to digital products (more scalable offers) is a lot harder than most people would want you to believe.*

*Maybe those people are trying to sell you a product that makes it look “easy?” Remember that the next time you get sucked into a “how to grow your digital product biz to $X,000s in just 4 weeks” rabbit hole 😉.

The reality of online business is that it’s much harder, more stressful, and takes a ton more trial and error than you’re led to believe. We know you CAN do it, we just like to be 100% real about what it takes so that when you hit obstacles, you don’t think there’s something inherently wrong with you.

Now that your client business is humming along, you’re probably at max capacity and can’t grow your revenue much further because you don’t have any extra time in your day/weeks to take on any more clients. This is why building a digital product is sooooooo helpful, because it’s a scalable asset that can generate revenue well beyond what you could ever make with clients and the limitations of your time.

In our experience, we’ve found some of our most successful digital product ideas have been born out of our existing client service offerings.

For example, 👩🏻🦰 Caroline’s brand design business could only take on so many branding clients. As she got more and more requests, she realized she might be able to teach all her branding processes in an online course that anyone could take at their own leisure. Thus, Better Branding Course was born, a digital product that eventually replaced Caroline’s brand design business completely!

How do you validate that idea?

How do you make sure it fits within your current biz?

😱 We have an entire (paid) coaching session we’re going to let you watch IN FULL right now…

Our Identifying Your Offer 💡 coaching session replay will help you come up with a digital product idea that can be the foundation of your business revenue.

You came up with a digital product idea, happy dance for you 👏👏. Now, let’s build that sucker and give strangers on the Internet a way to purchase it from you. Whether you’re creating an e-book, online course, or paid membership community, these next tips should apply.

Annnnnnnnnd BOOM GOES THE DYNAMITE! 💥 You have a digital product in your business-arsenal! It’s a thing people can purchase from you that doesn’t require additional time investment the way your client service offers do. Hurrrrray! 🎉

Bringing back our ongoing example company, Oodles of Poodles 🐩🎨, a Squarespace design company for yoga instructors, the digital product they’ve decided on is: Squarespace website creation course for non-designers. This course will be targeted at folks who don’t have thousands of dollars to pay for their site to be done for themselves but they also don’t want to create a Squarespace site entirely on their own.

And here’s where the train goes off the rails for most folks who are trying to make the client-to-product leap. They 1) find their product idea, 2) make their product, and 3) sell it (ONLY) one time. And then… 🦗🦗🦗.

Life gets busy, clients pick back up, maybe the first launch doesn’t quite go very well (we’ve all been there!)

That’s where this tip comes into play and should absolutely help you generate ongoing consistent digital product revenue!

Your (new) digital product NEEDS a monthly promotion schedule. To create that consistent, gradual 🦋 revenue bump you’re looking for, it takes ongoing effort – especially early on.

Here are some digital product promotion ideas to try:

Hosting a free monthly workshop is a fantastic way to generate attention and potential buyers of your digital product. The idea is to solve a problem with the workshop topic, that people can attend for free, and then at the end of the workshop sell the digital product (which further solves the problem of the workshop).

Creating in-depth tutorial videos is akin to writing those foundation articles we talked about last month! You want to identify topics your ideal customer is searching for and create helpful videos that educate them on that topic. Then, in every video, make sure there’s a call to action to get more helpful info via the digital product.

If these two ideas don’t tickle your fancy, we have an in-depth article with 13 marketing blueprints you can steal and implement for your biz.

And just a friendly reminder: We started with client businesses, gradually transitioned into digital products, and now a few years later we only have digital product businesses that afford us the freedom we always dreamed of (both in time and in enough revenue).

It is absolutely possible for you as well it just may take longer than you’re being told by the “experts” out there.

⚡️ Tip #1: Create and validate your first digital product idea.

⚡️ Tip #2: Once you have a validated digital product idea it’s time to build it and make it available for purchase!

⚡️ Tip #3: Create a monthly promotion schedule for your digital product.

At this stage in your business, it may feel like you’re in constant juggling-mode 🤹♀️🤹♂️🤹 (you’re not alone!)

Our hope for this section is to share three tips that absolutely changed the game for us, but it’s important to remember these next tips came AFTER we did all of the things in the previous sections. Notice we’re going from $5k to $10k here, NOT $1k to $10k (that’s important!)

You probably read that tip and were thinking, “um, hey Jason and Caroline, how does honing my messaging help put dollar-dollar-billz in my bank account?” And to that, we would answer, “keep reading, ya silly goose! 😂”

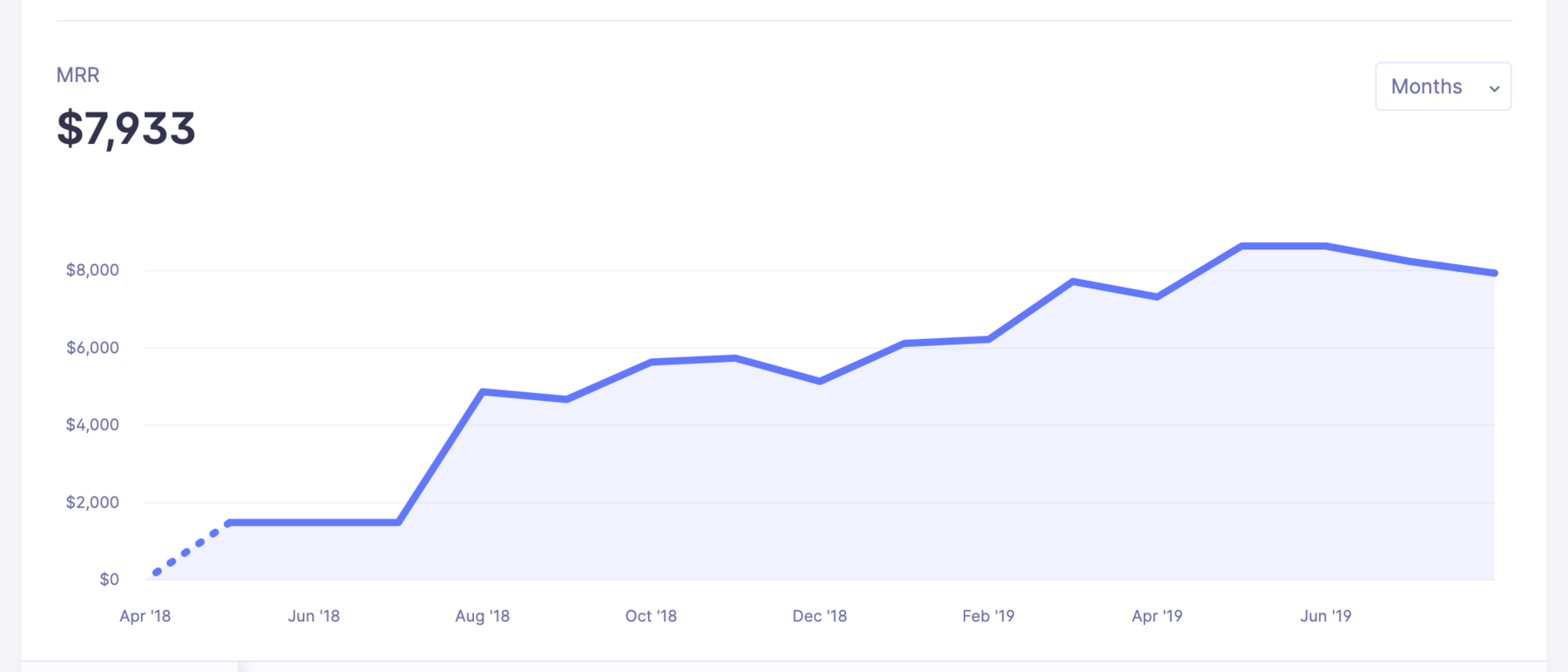

Very quickly, let’s jump into the Wandering Aimfully (WAIM) Time Machine™ and take you back to the summer of 2019. Our WAIM business had been chugging along for almost two years, but we didn’t quite feel like we had our messaging locked in.

Here’s our exact monthly revenue back in 2019, sitting right between the $5k and $10k mark where it seemed to have stalled out:

The problem we were solving for our customers was a bit vague and our product itself wasn’t selling like proverbial hotcakes 🥞. We knew we could help transform the businesses of our customers, but that clearly wasn’t coming through in our marketing.

It was at that moment we decided to get laser-focused on what our core product should be, who it should be for, and how someone would know it was absolutely right for them.

Fast forward a few months and we did our first launch (more on this in Tip #2!) of our Un-Boring Group Coaching Program. This was the first launch of WAIM that really exceeded our sales goals, and we finally saw the traction we’d been searching for!

Those three items, together, are what helped us springboard to the next level in our business revenue. It’s soooo easy to continue to use the same messaging and copy you always have, but we believe you should be auditing these things often.

💡 PRO-TIP: If honing your messaging isn’t in your wheelhouse, we highly recommend finding someone who can help you do this. Investing in this part of your business is crucial at this juncture and is worth every penny to learn who you are talking to and what benefits you are providing them!

Open and closed launches are one of our favorite ways to generate our business revenue (especially to create a jump in 💰💰).

If you aren’t familiar with them, an open and closed launch is simply a set period of time when you “open the cart” and allow people to purchase your product. This creates the urgency to purchase but more importantly, puts YOU in control of when you have to be in sales mode.

We shifted our WAIM biz model to bi-annual open and closed launches back in 2019, and we’ve been loving the flexibility, freedom, and predictable injections of revenue ever since!

🤔 Is your messaging from Tip #1 resonating with people during your launch, or are they asking a lot of questions about your product/who it’s for?

🤔🤔 Have you had a bad launch before? That’s okay! Don’t compare a previous launch of a completely different product to what you’re selling now.

🤔🤔🤔 Does selling still feel icky to you? Prove to yourself that selling doesn’t have to be sleazy and that people on your email list/social don’t mind being sold to (when what you are selling can actually benefit their livelihood!)

If you get a launch or two under your belt and your customers aren’t buying at quite the pace you expected, consider offering a lower-priced “entry” version of your product. This is exactly what we did with that 6-Month Group Coaching package we mentioned. We still had our larger ($2,000) offer, but the coaching package was $100 per month for six months ($600 total, obvs). We found the “entry” product became a solid source of immediate revenue but then also led to those happy customers upgrading to our larger product when the six months finished up.

Hey….. Guess what, chicken butt? We also have a FULL coaching session within our WAIM Unlimited program called Sales Launch Start to Finish 🚀. This coaching session teaches everything we know about launching and what we’ve learned that works really well for our bi-annual launch schedule.

✅ You’ve nailed your messaging.

✅ You’ve done your first launch or two.

✅ You feel like you have all your business-ducks 🦆📊 in a row, it’s now time to find more ducks! (We know, we’re mixing metaphors in this section, it’s FINE.)

This is the tactic too many online biz owners jump to way too early in the game. They pour effort and energy into marketing, except the thing they are marketing (their offer) isn’t working that well yet so it’s (somewhat) wasted effort.

Sure, we always want you amazing humans to be doing more marketing than you currently are, but we don’t want you to expend all that effort without having all the foundational stuff in place.

That said, once you DO have your offer locked in, one of the MOST effective marketing tactics to get a bump in revenue is to partner up with someone who has a highly engaged audience in your product arena.

You want to find someone who is willing to share the spotlight with you and promote your product to their audience so they can make a sweet % of revenue without having to create your offer themselves. Your pitch to someone in this position is that you’ll give them as much as 50% of product revenue sold during the partner event and they’ll promote the initial signup of the event to their audience.

Example: Our friends at Oodles of Poodles 🎨🐩 (our example biz that does Squarespace design work for yoga instructors and also teaches a Squarespace design course) are going to partner up with a prominent Squarespace template company: Temptation Templates 💋🖥.

The great news about partnerships? There are MANY ducks in the sea! (We had to bring the ducks back and mix just one more metaphor in here).

If your first partnership doesn’t work out, figure out why. Just like one lackluster product launch doesn’t mean all launches won’t work, a partnership effort that falls flat doesn’t mean all partnerships won’t work!

And remember, especially with Tip #3, you’re NOT trying to do everything at one time. You can space these tactics out and you can tackle them on a schedule that works for your life and biz. We’re all about that slow 🐌 and steady 🐢 pace around here.

As with all of the tips we’ve been sharing these past few sections, these come from our very personal experiences.

These aren’t just theories we’re conjuring up from our business crystal ball 🔮, these are well-worn strategies we’ve implemented to help us make real jumps in our biz revenue.

We know these can work for you, it’s just about carving out the time to make them happen while having an experimenter’s mindset.

⚡️ Tip #1: Hone your product messaging. What problem are you solving for people?

⚡️ Tip #2: Do an open and closed launch of your digital product 🚀.

⚡️ Tip #3: It’s time to utilize effective partnerships.

It wouldn’t be a section in this article if we didn’t give a big, juicy caveat before sharing these last three tips with you:

Growing your business to $10,000++/month and beyond is NOT a requirement for a “successful business.”

It’s not the only way to reach your dreams and goals in life. Most of those can actually probably be done with less money (as many studies have shown). Always remember this, friend, when you catch yourself thinking your worth as a business owner can be measured in dollars. IT CAN’T.

These last tips will show you the exact steps that helped us take a leap to reach our “enough number” in business revenue, where we happily sit and don’t need to grow just for growth’s sake.

At this point in business, you most likely have a few content things going on: An awesome weekly email newsletter; a fun-but-helpful podcast; an info-packed YouTube channel; a pin-worthy Pinterest plan; an interestingly-designed IG grid, etc, etc.

But, what you might not have, is a clear directive and STRATEGY for each of those content buckets. You may also not have a clue if any of them are direct contributors to your revenue (if you do, kudos to you, we did not at this stage of biz 😂🤣).

📬 Your Email Newsletter: This is your real-time, value-packed piece of trust-building content with your audience. You want to have a clearly defined schedule your audience can get used to as well as a specific outcome they can expect with each email they receive. Then (and this is the strategy part) make sure you have a business objective being met in EVERY email as well as a lead-up plan for your product launches.

🎙 Your Podcast: This is one of your strongest connection points to your audience, even though podcasting is a very passive listen. The reason it’s such a strong connection point is because it’s a somewhat intimate relationship. People listen to podcasts while living out their day-to-day lives and you get to be alongside them in those moments! You know, doing the dishes, driving to work, walking the dog, taking a shower, etc. But the trick with making a podcast strategic is to ensure you have reminders of the product you offer in each episode!

We think you get the idea with each content channel, but the key is to make sure you’re not just churning out content without thinking strategically of how it can impact your business.

You might be thinking, “great, I can do all those strategy things, but how do I see the actual ROI of my content efforts??”

⭐️ SUCH A GREAT QUESTION! Thank you for asking…

You create a post-purchase survey!

A post-purchase survey is an embedded form or a linked form your customer sees immediately after buying your product. In that survey, you can ask a series of questions but one of the most important things you can ask is: “How did you hear about this product?” And you list out your content channels!

When we finally implemented a post-purchase survey (a Typeform embedded directly on our “thanks for buying” page), we found some really interesting data points:

That’s AWESOME for us to learn! Mostly because a content strategy can feel a lot like being on a never-ending hamster wheel. But, that hamster wheel gets easier to ride when you can see a certain % of your revenue comes from specific channels!

The post-purchase survey is also a great way to identify any content channels you might not be loving and thinking about cutting out. If your customers aren’t finding you through a certain channel, this can give you the data point you need to stop investing time and energy into that channel 💪💪. For us, this was Instagram and what helped us decide to stop using Instgram for WAIM at the end of 2021. (And our revenue has NOT plummeted since!)

Okay, we could write a 2,000+ word article just on creating an affiliate program, but we’re going to distill it down to the actionable stuff we hope can help you right away.

Adding affiliates to your business when things are on shaky ground is only going to cause headaches in the future (and create possible bad relationships). Our advice is to only move forward with affiliates if things are humming along smoothly!

For us, we use Affiliate WP (aff link) which is a WordPress plugin built by the same company that we use for our Membership Program (Restrict Content Pro – also aff link). There are MANY affiliate programs available so just be sure you pick the one that fits right with your website.

We do the following for our WAIM Affiliates:

The last thing you want to do is leave your affiliates feeling like they have to do everything on their own. You want to make their promotional efforts as SIMPLE as possible so it’s a no-brainer for them to promote and support your program.

As a fun note to finish off this tip, in our previous two WAIM Unlimited launches, affiliates have accounted for 50% of our new members! 👏👏👏 We’ve had a sizable jump in revenue with each launch due to affiliates and love that new customers are joining our program from existing members!

Once you work through the tips of the previous section and Tips #1 and #2 in this section, it’s probably time to pour a little biz-accelerant on your marketing fires.

What content channel is working THE BEST for you?

Is it your podcast? Your YouTube channel? Pinterest? IG? Etc? Whichever one it is, you want to identify it and brainstorm ways to pour biz-fuel on that wonderful, very safe and not hot, marketing fire 🔥!

Our last example for our dog-loving Squarespace compadres: Oodles of Poodles 🎨🐩 has a weekly podcast we told you about in Tip #1 called Grooming Squarespace 🎙✂️. Poods’ has noticed an uptick in podcast listenership and has seen a good amount of people have been visiting the podcast-only page they direct people to on their website for more helpful Squarespace Tips. They’ve also done a recent launch and noticed 15% of their new customers found them via the podcast (rad!)

Oodles of Poodles 🎨🐩 is going to focus on growing their podcast listenership by trying to appear on other podcasts. They take the time to research the top 20-40 Squarespace-related podcasts (or design-related podcast where Squarespace is mentioned) and they build an outreach plan to be a guest on these podcasts – making sure they only reach out to shows who have guests. Their pitch is to appear as a podcast guest and share an actionable set of Squarespace tactics most people don’t know about. This helps the other podcast hosts know value will be given to their audience and it’s not just a random pitch hitting their inbox.

Showing up on these other podcasts gives Oodles of Poodles 🎨🐩 a chance to promote their Grooming Squarespace 🎙✂️ podcast and increase their audience!

It might not be a podcast you’re going to amplify but the key in this final tip is to look for a marketing channel that’s already having some amount of success and growth and 🔥 it up a bit!

We couldn’t finish the final 🦋 section with just three tips, could we??

When we get asked how we run TWO online businesses and create all the content/stuff we create, with virtually NO team at all (we do have two developers for our software app Teachery), the answer is PROCESSES.

Need to write a weekly email newsletter? Here’s our process:

That may sound simple, but it’s a repeatable process. It’s what’s helped us write and send 800+ email newsletters over the past 8 years.

We have similar processes for our podcast, YouTube channel, articles, IG posts (R.I.P. ☠️), monthly live coaching curriculums, customer update emails, new products we build, new features we add to our software app Teachery, etc.

We also have daily, weekly, monthly, quarterly, and annual meetings together. Those meetings have a structure to help us know what to focus on and how to keep the WAIM Train 🚂 moving forward!

Good processes, ones that you hone yourself from experience and learning from people who do the things you want to be doing, are how you can get more stuff done AND not burn yourself out.

*We do want to acknowledge that not having kids (yet) makes our output a lot easier. That’s an intentional choice we’ve made. We also want to acknowledge our inherent privileges (things like our education, upbringing, being neurotypical) that we know contribute to our ability to create processes and execute within them. We know this might not be as simple for everyone, but we hope you’ll lean into what works for your brain, your life, and your circumstances!

⚡️ Tip #1: Dial in your content strategy.

⚡️ Tip #2: Create an affiliate program.

⚡️ Tip #3: Amplify the marketing bridges that are working!

⚡⚡️ BONUS TIP: All the tactics in the world are useless if you can’t get things done.

Hurrrrrraaaayyyyyyy for you making it through this Grow It Gradually 🦋 article (hopefully you didn’t just click through to this section looking for a silly GIF of us 👀😂).

There is NO straight line to success but there is a clear path we’ve followed and we believe you can follow too (with your own tweaks along the way!) Just remember: NO one jumps from $0 per month to making $10,000++ per month overnight or even in a few weeks/months.

What we’ve shared in this article is yours to come back to as often as you like! As un-boring coaches, we’re happy to support your journey as much as we can but YOU have to do the work. We can guide you and teach you from all our personal experiences but we can’t build your business for you.

You can do this.

You’ve got a plan of action.

Carve out the time and space but go at YOUR pace 🐌🐢🦋.

And now, your silly dancing GIF of us to celebrate!

Heads up: This post was first created on September 1, 2018 and the final entry was written on October 21, 2021 when we hit our Enough Goal! ✅ 😍

We’ve decided to publicly share our journey to making “enough” money with Wandering Aimfully. The idea behind this is not to show off how much money we’re making, the idea is to show exactly HOW we’re doing it.

One of our core values here at Wandering Aimfully (or WAIM, as we like to abbreviate it and will do throughout this post) is transparency.

Transparency becomes especially important to us when it comes to money because there are so many emotions and thoughts that often get tied to money (greed, shame, self-worth, happiness, embarrassment, etc), some of which can present challenges to the way we pursue our goals.

Before we get too deep into things, you might not know who the heck “we” are, in which case you may want to mosey on over to our About Page to learn more about us—Jason and Caroline Zook. If you just want the TL;DR version: We’re a husband and wife creative duo, with no employees, running our own businesses for over a decade, currently living and working together in Southern California. For good measure, here’s a super cute photo of us…

Now that we’ve met, let’s talk about this goal of getting 330 people to join our Wandering Aimfully Membership.

From years of experience, we know how it easy it is to get fixated on making more money. Yes, we know how good it can feel to see a couple extra thousand dollars in your bank account after a big launch, but we also know the mental toll it takes to constantly be in promotion, marketing, and sales mode. That’s partly why we’ve decided to give ourselves an “enough number.” When we finally reach this number, we can stop feeling the constant pull of promotion. We can focus fully on the amazing community we’ve built, rather than constantly be searching outside of the community for more members.

We also believe that defining your enough is the only way to ever feel satisfied. So often we focus on the vague word “happiness” without defining what it really is. We believe a big part of happiness is this notion of satisfaction. So, let’s explore for a second this idea of satisfaction.

One definition we found for the word satisfaction was:

The pleasure derived from the fulfillment of one’s needs.

Think of your wants and needs as an empty bucket. The pursuit of fulfillment is the quest to fill that bucket, and satisfaction is the pleasure you get from recognizing it’s indeed full.

But here is the root of why satisfaction seems to be so elusive:

How can we be fulfilled when we have no idea how big the bucket is we’re trying to fill?

Without defining what your needs are—without setting that benchmark—you will just keep trying to fill a bucket that’s endlessly expanding. That’s a recipe for a lifetime of discontent.

Instead, if you want to experience satisfaction (ie. happiness), you need to define how big your bucket needs to be…and then you need to recognize it when it’s full.

Or, in other words, you need to figure out how much is ENOUGH.

Getting to 330 paying Wandering Aimfully members within 12 months time will net us $33,000 in monthly recurring revenue (MRR). After we hit that number, we’ll close the proverbial sales-doors and stop accepting new members. We aren’t interested in continuing to grow our membership community (and make more money) just because we can.

In a highly digital world, we want to plan for and offer a personalized touch.

Why 12 months? Each month we’ll limit new memberships to 30 per month, so technically we should be able to get to our goal before 12 months (yay, math!), but we want to leave a bit of buffer in our membership signup planning especially because we know we’ll have some customer cancellations (aka churn). Limiting our memberships to 30 new people per month allows us to deliver as much of a personalized experience as we can, including some non-digital stuff.

Additionally, limiting the amount of new monthly members ensures that the community doesn’t feel crowed or overwhelming to our existing awesome members. It’s important to us to preserve the culture of the community, which we know to be one of our major selling points and differentiators.

For context, it might also help you to know how our membership pricing works. It’s very simple:

Both membership options include the exact same thing, the annual option simply saves someone a couple hundred dollars by paying in advance. If you want to learn more about what we include in our WAIM Membership, click here.

We’d be remiss if we didn’t mention some important advantages we have in this Journey to 330:

There’s no denying those are helpful pieces of this puzzle that we already have at our disposal. That being said, this is a new business offering for us and for our audience.

We told you we value transparency, didn’t we? Well, it’s about to get really real up in here.

A fundamental part of our approach to work and life is a philosophy we call Working To Live. Part of this ethos is the belief that living a fulfilling life begins with establishing our ideal lifestyle and then reverse engineering our business decisions to support and align with this lifestyle.

Using this approach, we first identify what we WANT, and then we back out how much money we need to get there.

That equation is how we arrived at our specific number of $33,000.

“We first identify what we WANT, and then we back out how much money we need to get there.”

That number may or may not seem outrageous to you. It’s taken a lot of restraint not to write paragraphs of text defending how much we spend in living expenses every month. But therein lies the problem when it comes to money: we constantly feel like we’re being judged or we feel we have to be on the defensive about our spending.

So, how about this as justification…We spend this much money every month to live lives we absolutely love. It’s awesome to be able to do that, right? We agree! But, it wasn’t always this way. In fact, it was just back in 2013 we spent $4,000 per month and could barely make ends meet (you can read our getting out of debt guide here).

Here are how our monthly living expenses break down in broad strokes:

*We don’t actually spend $2,000 on travel per month, but the past two years we’ve averaged spending about $20,000 on travel per year. We put this as a monthly “expense” to keep a watchful eye on it.

**Donating to causes we care about is a big part of our Journey to 330 goal as you’ll read in a moment.

Our business expenses have fluctuated quite a bit over the years due to how many different businesses and projects we have. That being said, one of our huge goals with starting WAIM was to streamline all of our projects into ONE membership and create a much more predictable set of business expenses. We believe this number is actually going to decrease over time, but for now we’re using a comfortable monthly average (which we’ll share more about in detail as the monthly updates continue to get added to this post).

Oh taxes, you necessary evil, you. First, we aren’t going to be those people that gripe about paying taxes. We understand and believe in taxes. This monthly average number will absolutely change over time, but we’ve decided to base it on our previous two years of business (taking what we paid in total taxes annually and dividing that by 12 to get a monthly average number). We do a /decent/ job of setting aside money for our taxes each year, but with a more predictable MRR going forward, this will get much easier!

Have you heard of this mystical thing in business called “profit??” It’s a pretty crazy phenomenon we’re just hearing about! It means that you don’t just spend every dollar your business brings in, but that you can keep some of it! It escaped us for a few years, but we’ve decided to utilize its wonderful powers going forward and put a much heavier focus on it 😂. Alright, jokes aside, our goal is to have $10,000 every month we can put into our savings, investments, and not touch at all. We’ve NEVER been able to predictably save a sizable amount of money each month and we want that to change.

It’s probably worth mentioning that we *have* been saving and investing the past few years, just not in a super regimented fashion. You can read how we currently invest and save our money here.

It can be really hard to give money to organizations and great causes when you can barely eek a profit out of your business. We’ve managed to redistribute some of our wealth every month since 2018 because we’re finally prioritizing it, but we want to do much more. Part of this Journey to 330 is to bake charitable giving wealth redistribution into our financial plan. We want to allocate 10% of our total monthly revenue to non-profit organizations, causes, and other acts of good that come onto our radar each month. The idea of having $3,000 every month that we can give away and help make a difference is something we’re really excited about!

**

Those five categories of money add up to $33,000. As a reminder, our goal is to hit $33,000 in monthly recurring revenue in 12 months (that would be by September 1, 2019). Will it happen? What are we doing to make it happen? Find out each month going forward by referring back to this post. We’ll add an updated section each month with how our launches are going, what we’re doing to reach this goal of 330 members, and how our feelings continue to evolve about this enough goal.

SPOILER ALERT: We absolutely did NOT hit our enough goal of $33,000 in just one year 🙈😬🤣. Boy, was that wishful thinking! Keep on reading to find out how we finally hit that goal after 3 years.

As of September 1, 2018:

Monthly Recurring Revenue (MRR): $4,783

Total Paying WAIM Members: 48

Monthly Profit and loss:

Total WAIM MRR: $4,783

Total WAIM Fees (Stripe/PayPal): $145

Total Expenses to Build WAIM: $16,500

Monthly Expenses in August: $7,460

TOTAL PROFIT: -$19,177 (eeeeek)

Quick hits of what we did to get this first group of paying members:

Ideally, we would’ve started this public journey at $0 MRR. Unfortunately, it takes a lot of time to put something like this Journey to 330 post together and we simply didn’t have the time while we were building our actual website and business. Every hour we had from March 1 – August 19 (2018) was spent bringing Wandering Aimfully to life. During that time we did a pre-order of our WAIM Membership and a first public launch.

In trying to keep this first update as succinct as possible (the irony is thick there), just know we spent five months planning, designing, building, working with developers, going through 400 of our past articles, riding a bunch of emotional roller coasters, creating our purchasing flow, and completing well over 2,000 tasks to bring this website and our membership offering to life. We also had a website dedicated to the behind the scenes of building WAIM, which was live from March 1 to August 19.

Before WAIM was finished being built, we knew we wanted to offer a pre-order for our memberships. We made this decision based on two things:

We opened up our pre-order for just one week, limited it to 30 buyers only, and sent three emails to a list of 400ish subscribers (this was a segment of our bigger list that had opted into daily-ish blog posts about how the build was going). Our three emails were fairly simple and explained the gist of the membership, the existing courses/workshops they’d get access to, and then a tease of what was coming in future months with WAIM.

There was only one hitch: We told our pre-order members they wouldn’t get full access to everything for at least a month (sell before you’re ready!)

While they’d receive access to our courses, this custom member dashboard we kept telling them about wouldn’t be fully coded for at least another month. Would people still pre-order if they couldn’t get the full experience right away? Well…

(You’ll notice the Airtable view of customers only shows 13 people and this is because two of our pre-order members canceled a few months in – sad panda. We’ll talk more about this in a moment.)

With our website finally up and running it was time to do our first official launch! August 20 was the start date and we would leave the “cart” open for one week, again limiting the number of buyers to just 30 people. This launch was quite a bit different from our pre-order because it also coincided with the website going live and we sent sales emails to our entire email list.

We decided early on that we’d write a behind the scenes journal sharing all of our processes, decisions, roadblocks, problems, and even share full unedited video meetings. From March 21 to August 5 we created and shared:

Here’s what that looked like…

Caroline’s previous email list (Self-Made Society): On August 5 Caroline mentioned that WAIM was coming on August 20. This was sent to 5,502 subscribers and 1,514 of those subscribers opened the email (27.5% open rate).

My previous email list (JasonDoesStuff): On August 7 I mentioned to my email list that WAIM was launching on August 20. This was sent to 11,538 subscribers and 2,477 of those subscribers opened the email (21.5% open rate).

Our first combined newsletter (Wandering Weekly): On August 13 we sent our first combined email newsletter prepping the subscribers of our new website and membership on August 20. This was sent to 16,684 subscribers and 2,411 of those subscribers opened the email (14.5%* open rate).

*Something definitely went wrong with this email broadcast. We actually reached out to our email provider and they admitted something looked weird. Unfortunately, we had too many to-dos on our list to diagnose things and didn’t want to try to resend the email with fear of something else going wrong or happening with our email reputation.

We shared teasers and whatnot on social media: While our social media follower numbers are nothing to scoff at, it’s important to note we also don’t see social media as a huge driver of new traffic or sales. Even though I have 31,000+ followers on Twitter, the engagement of even the most exciting of tweets is VERY low. Caroline has 2,900+ followers on Twitter, but I think she’d echo my statements about engagement (and she mostly just pushes her Instagram posts through to Twitter). Speaking of, Caroline wins our household Instagram award with 16,000+ followers; I have just a touch over 3,000 followers; and Caroline runs our @wanderingaimfully account which has 900+ followers. Those numbers are just to give you an idea of the impressions we’re working with. Numbers aside, we posted a handful of tweets with teaser images, shared a few stories on Instagram, and just generally kept people tuned-in to the launch date of August 20. Caroline did work some pretty awesome grid-magic on IG (as you may have noticed in the “Lead Up Stuff” image above).

This isn’t our first rodeo selling something over the course of a week. We knew we didn’t want to be writing and sending sales emails the night before (we’ve done that too many times and it’s stressssssful), so instead we whipped up a Google Doc and wrote all our sales emails in one spot.

Pro-tip: This is also a great way to get the subject line, preview line, links, etc organized ahead of time.

Then Caroline worked her wizardry in our email provider ( Drip [aff link]) to set up a “campaign,” which is just a string of emails with a simple sending schedule (shown above). Here is the timing of the sales emails along with the general topic discussed:

These emails were sent to our newly combined (as of August 13) Wandering Weekly email list minus the last email in the campaign because we hit our goal and didn’t need to send a “Last call” email. Who turns off one extra sales email during a launch knowing it would probably bring in more sales? We do. That’s who.

In the image below you can see the open rates improved greatly using this email campaign in Drip, as opposed to a normal broadcast email (very odd). And a couple email stats for you:

*Truthfully, we’re happy to see people unsubscribe as we know our content and membership isn’t the right fit for them.

35 new customers, what happened to 30? Ahhh, you are astute! So, a couple things happened which led us to end up at 5 buyers over the 30 number we set:

With that out of the way, let’s look at when people bought during the launch:

We offer credit card or PayPal as a buying option, so here’s the split on that:

*PayPal actually wasn’t working for the first four days due to two technical issues we missed. We finally got them fixed but have no idea if we missed out on folks who wanted to purchase via PayPal. Oh well.

And finally, the traffic to WanderingAimfully.com during the launch:

There’s no doubt in our minds that the initial launch is the most exciting time for people. It’ll be very interesting to see if we can keep up our pace of 30 new members each month going forward.

And now, the best and worst parts of our first official launch:

We can’t stress enough how excited we were to get Wandering Aimfully launched, but more importantly, to have a new group of amazingly talented and creative people in our community.

It’s hard to categorize anything as the “worst” part when things go pretty much to plan. If we had to mention something here, it would probably be how much stuff we have to do manually behind the scenes for a new customer that buys via PayPal. We won’t bore you with all the details, just know that each PayPal customer requires a bunch of manual processes that we’d love to automate in the future, but had to launch without (even though we tried to automate them months prior).

We’ll be using Baremetrics to track our member growth progress and revenue and you can actually view our public MRR dashboard here. Baremetrics is super neat because it helps you keep track of customers, revenue, churn, and lots of other powerful recurring revenue stuff.

A big shout out to Josh and his team for getting us hooked up on Baremetrics and making it really easy to update our Airtable with actual monthly revenue.

**

That’ll do it for this first update! Now, it’s time to get to work on creating new stuff for our WAIM Members and executing our plans for the lead-up to our October launch.

👍👍

As of October 10, 2018:

Monthly Recurring Revenue (MRR): $6,350

Total Paying WAIM Members: 62

Monthly Profit and loss:

Total WAIM MRR: $6,350

Total WAIM Fees (Stripe/PayPal): $160

Monthly Expenses in September: -$3,496

TOTAL PROFIT: $2,854

Quick hits of what we did to get this first group of paying members:

This is our second update on our Journey to 330 and man-oh-man do I have ALLLL the thoughts to share. If you are unclear of our “growth strategy” with selling our Wandering Aimfully Memberships, the goal is to open the doors every month and only allow up to 30 new paying members. One thing that you’ll notice between the first and second update is that our assumption about our expenses was correct. We can’t live off the $2,854 in profit we made this month*, but it’s great to know that our business is not making more money than it spends (after just two months!)

*If you’re wondering how we’re keeping the lights on since we aren’t making the profit needed to cover our total living expenses, we have ongoing payments from our previous BuyOurFuture project as well as revenue from a few other online courses and software products. Truth be told, these Fall months will be tight financially and we hope we don’t have to dip into our savings!

Looking at the month of September, we had a hunch that the luster would wear off during our second launch and I’ll talk more about that in a moment. But, one really big thing happened between the first launch and our second launch and that is that life took a big steaming 💩 on our faces…

You know that phrase everyone (including us) like to throw around: “Plan ahead because life will shit on your face.” Well, it happened to us in a big way in September. My lovely and very healthy wife mentioned she had some tightness in her neck at the beginning of September and a few days later we found ourselves in an Urgent Care doctor’s office hearing that Caroline was diagnosed with shingles. Oof.

I’ll save you all the intimate details of how bad shingles can suck, but here’s the painful timeline of how it went down:

Those five weeks happened between the first launch and second launch of Wandering Aimfully and unfortunately, it left us a woman down in the work department. While I tried to carry my weight and tow the line of everything we had going on (and keeping my other business ventures afloat) I spent the majority of my time trying to give Caroline any ounce of comfort possible. It was difficult not being able to work like we normally do, but truthfully, it was an emotional few weeks for me and an insanely few painful/emotional weeks for Caroline.

I don’t want this entire update to be about our run-in with shingles, but it’s worth noting that you DO have to prepare for these life hiccups to happen. You can be mad about it, you can be frustrated about it, but you can’t just fast forward life so you hunker down and deal with it the best you can.

I’m happy to report that Caroline is feeling 1000% better than she was during week one of shingles, but she still has some lingering issues (which we’ve come to discover are normal).

Earlier on in the summer, we made the decision to create a podcast and YouTube show where we’d talk about areas of life where we’ve wandered aimfully and share our experiences, stories, and lessons learned. Originally we were going to launch the show at the time of launching the website, but Caroline had a good idea to push the launch date of the show back a month so we’d have something fun to announce after the luster of our new website announcement wore off (good idea Carol!)

I’ve had a few podcasts over the years and one of the most important things I’ve done for my sanity in running them is to get AHEAD of the publishing schedule. We still had a ton of work on our plate during the summer months, but we carved out time to record five initial episodes of Wandering Aimfully: The Show. This was a clutch move because we couldn’t record a single thing in September and it was nice to know we had five weeks of episodes already recorded and ready to be edited.

I don’t want to spend too much time on the production of our show, but just know that:

I could, and may, write an entire article devoted to our plan and strategy with our podcast/YouTube show, but the short of it is we want to create a show that we’d enjoy watching. Our assumption is that we’ll deepen the relationship with our existing audience through the show, having them (you!) feel a connection to us that you can’t get through the written word. Could we see some external growth with our show? Maybe. But that’s kind of out of our control, so we’re not focused on that.

As of writing this second launch update, we’ve released five episodes and the total views/downloads are just around the 3,000 mark. To some people, that may be great! To others, that may not seem worth the 125+ hours we’ve put in. To us, we’re committing to the show because we enjoy it and we want to see how it goes for a few months.

EDITOR’S NOTE: After reading back through this section of the update I posted a note in the Wandering Aimfully Slack channel about how much work was going into our show and not being sure if it was actually going to pay off (just some straight-up #realtalk). I heard back from many of our members that they loved the show and it was doing exactly what we intended it to do. Plus, a few newer members said the podcast pushed them over the edge to join WAIM. So… hurray testing assumptions!

As you’ve read and understood, our goal is to get 30 new paying members each time we open the WAIM Membership doors. We are not naive and we understood that there would be a natural drop-off in membership with our existing audience.

As our October launch approached we were trying to figure out the best way to sell our memberships, but not oversell it to the folks who went through our full 7-day sales sequence just a few weeks prior. Here’s what we ended up doing for our second launch.

This group was made up of new email subscribers who went through our 5-day welcome email sequence and did not get our first launch sales sequence.

We dropped these folks directly in the same 7-day sales sequence we used before:

And the most important stat of all? 8* people purchased!

*Unfortunately, we don’t have concrete data to say that our email sales sequence was the sole reason these folks purchased, but they were all in that group of 408 subscribers, so we’ll take it! Also, we’re going to try to track conversions from the 7-day sales sequence better during our next launch (always room to improve).

I’m gonna be brutally honest and just come out and say it: I’m nervous that our email provider is having email sending issues. I’ve heard from another customer of Drip that they’ve seen a huge drop in email open rates, but it’s crazy to me that we went from an average of 20-25% open rates down to 10-15% since switching to a combined newsletter with a new from email address. That’s probably a topic for an entire other discussion, but we can’t do much about it now, so… let’s move on.

We sent our existing subscriber group three emails during our second launch:

Email #1: A normal newsletter about taking risks which aligned with our podcast episode that had a callout that memberships were open at the top (14% open rate).

Email #2: A dedicated sales email three days later focusing on wins our WAIM members shared with us with a bit more of a pitch to join (13.5% open rate).

Email #3: Another normal newsletter on the last day of the launch about confidence with a reminder callout that memberships were closing (11% open rate… but this data is written one day after sending that email).

It’s safe for us to assume that 8 of our new customers came from these emails.

So, where did the other 2 customers come from? Well… They found us completely out of the blue and joined in the last few moments! No joke. I emailed with both new customers who weren’t on our list and they said they hadn’t heard of us before joining but felt a real connection to us and WAIM and decided to take the leap. Pretty cool!

Honestly? And most people would probably try to hide behind fake optimism… It sucks. It sucks to put something out into the world that you truly believe can make a difference for folks, but to not see the conversions happen.

BUT… We knew it wasn’t going to be easy to get 30 new paying members each month and we also knew that September was a really tough month for us.

If we take a step back we can see that we have 18 new (awesome) members who believe in us. We can see that we didn’t do much marketing or promotion at all, with exception to launching our show (which, as stated, is more of an audience deepening decision, not a widening one). And you know what’s better than a big fat 0? 18! There is a tinge of discomfort that we missed our 30 mark, but, we’re grateful to have new members AND our existing group who continue to stay active members.

We have a second launch under our belt after having a pretty damn rough month personally. We still ended up with new members and even though we didn’t hit our goal, we were able to test some assumptions about the groups on our email list we could sell to.

Let’s finish up with the BEST and WORST…

We got some new members! 18 is way better than 0. The quality of the members of the second group seems to be on par with the first group (which is rad!) We were also really stoked that brand new subscribers converted to paying members, which bodes well for the future of our email marketing plans.

There are two things I want to share and you probably guessed the first one: Poor Caroline had to deal with shingles the entire month. It. Was. Awful. But, we made it through and she’s feeling so much better. Could’ve been worse!

The second worst part I wanted to share is that 5 customers canceled their memberships. Personally, I have some soul-searching to do on how I deal with people canceling, especially after only being a member for one month. I get it, people will cancel, it’s the name of the membership game… but that doesn’t mean it doesn’t suck and it doesn’t make me feel emotions (even though most of the time I have the emotions of a robot).

The silver lining to having people cancel is that we get to learn why they canceled. We can find ways to improve or to make our membership better. We absolutely believe WAIM is worth the $100 per month, but we also know we don’t have the best onboarding process for our new members. Hoping to spend time on this in the next few weeks!

**

Hope you enjoyed our second update on our Journey to 330! It’s as much a reminder to us as it is to you that reaching your goals isn’t going to happen overnight. It’s also not going to happen just because you hope and dream it will. You have to put in the work and you have to prepare for things to go wrong now and again.

As of November 15, 2018:

Monthly Recurring Revenue (MRR): $6,133

Total Paying WAIM Members: 62

Monthly Profit and loss:

Total WAIM MRR: $6,133

Total WAIM Fees (Stripe/PayPal): $128

Monthly Expenses in September: -$3,590

TOTAL PROFIT: $2,415

Quick hits of what we did this month:

Holy moly, where do we begin this month? Well… Let’s just go ahead and rip the band-aid off and jump right into the biggest emotional topic.

This is a very weird sentence to type, but we’re kind of glad our MRR went down. Wait, do we hate making money? Are we gluttons for punishment? Why the heck would we be happy that our MRR went down??

Here’s the deal, and it’s my belief it’s going to make total sense after you read this:

We like to see some tension. We need relatability. We need something to go wrong so we can see how the hero(es) overcome the adversity.

Now, if I’m being honest, I’d rather that drama didn’t involve how much revenue we generate, but it is what it is. The fact of the matter is that between October 10 (the end of our second launch) and November 12 (the end of our third launch) we had more people cancel than we had signup. OOF. Not great.

I’m the one who more closely watches our WAIM Memberships and it was a punch to the gut every time a cancelation email came through. All-in, we had 12 people cancel their WAIM Memberships which increased our User Churn to 16.9% (industry average is 11%).

The wise and experienced co-founder of Basecamp, Jason Fried, once said that you learn the MOST about your product right when a customer signs up or right when they cancel. When a new customer joins, ask them why and find out if there are recurring things that are attracting and converting people (and do more of that!). When a customer cancels, asks them why and try to fix that problem asap. So, that’s exactly what I’ve been doing with every WAIM Member who’s canceled.

I would have expected members who canceled to say things like: You guys aren’t as helpful as I thought or Your products aren’t what I expected or I just expected something completely different. But, we didn’t hear any of that. In fact, we’re seeing people cancel their WAIM Memberships because we have TOO MANY products. We’re hearing that folks believe in the value of WAIM, but they were overwhelmed by all the products available and not sure where to begin. And while that might seem like a good problem to have, it’s still a problem that needs fixing because it is causing people to leave.

Can I just pause for a moment and be brutally real with you… Emailing people and asking them why they canceled is humbling. It’s not fun. But, if you’re trying to build something that can last and that can make an actual impact for your customers, you have to push through the uncomfortable moments. Every time I hit send asking people why they canceled it feels crappy. But it’s necessary, and I’ll continue to do it.

I’m going to save the answer to this question until the final part of this month’s Journey to 330 update. For now, let me take a break from talking about everything that went wrong and share some stuff that went RIGHT!

One of the things Caroline and I enjoy most is teaching live workshops. Caroline is amazing at coming up with frameworks and processes that we can use ourselves and pass on to others. The live video element takes me back to my IWearYourShirt days where I hosted a 1-hour live video show daily for nearly 5 years straight (yeah, you read that right!) There’s something about the energy of speaking to people live and getting immediate feedback that lights us both up.

This workshop was initially supposed to happen during our second launch but with Caroline still not feeling great we had to postpone it a bit. Instead, we held the workshop on October 18 and had 232 people register. Of those 232 people, 139 showed up to the event which is a whopping 61.5% attendance rate (that’s RAD!)

We didn’t have anything to sell on the workshop, so it was just 100% value-driven. That being said, we did have two people email us after the workshop who thanked us and said they would be joining WAIM because the workshop was so great (and they both stuck to their word and signed up during our November launch – wahoo!).